Buying or selling a property is a significant financial decision, and it’s crucial to have a thorough understanding of the local real estate market. One of the most important tools in the real estate professional’s arsenal is the comparative market analysis (CMA), which provides a comprehensive assessment of the market conditions and helps determine the fair market value of a property. In this comprehensive guide, we’ll delve into the world of comparative market analysis, exploring its importance, key components, and the steps to conduct an effective analysis. We’ll also discuss the tools and resources available, common mistakes to avoid, and the future trends in this essential real estate practice.

Introduction to Comparative Market Analysis

Comparative market analysis is a process used by real estate professionals to evaluate the value of a property by comparing it to similar properties that have recently sold in the same geographic area. This analysis takes into account various factors, such as the size, age, condition, and amenities of the property, as well as the prevailing market conditions. By comparing the subject property to these comparable sales, the real estate professional can determine a reasonable asking price or offer price, helping both buyers and sellers make informed decisions.

Understanding the Purpose of Comparative Market Analysis

The primary purpose of a comparative market analysis is to provide an accurate assessment of a property’s value based on current market conditions. This information is crucial for both buyers and sellers, as it helps them make informed decisions about the property’s worth and negotiation strategies. For sellers, a CMA can help them price their property competitively, while for buyers, it can help them determine a fair offer price.

Defining Comparable Properties

Comparable properties, or “comps,” are similar properties that have recently sold in the same geographic area as the subject property. These properties should have similar characteristics, such as size, age, number of bedrooms and bathrooms, location, and amenities. The real estate professional will typically select three to five comparable properties to use in the analysis.

Analyzing Market Trends and Conditions

In addition to comparing the subject property to similar sold properties, the CMA also takes into account current market trends and conditions. This includes factors such as the overall demand for homes in the area, the number of active listings, the average time properties are on the market, and any unique market influences that may be affecting the value of the property.

Importance of Comparative Market Analysis in Real Estate

Comparative market analysis plays a vital role in the real estate industry, providing valuable insights that help buyers, sellers, and real estate professionals make informed decisions. Let’s explore the key reasons why CMA is an essential tool in the real estate market.

Pricing Properties Accurately

One of the primary benefits of a comparative market analysis is its ability to help price properties accurately. By comparing the subject property to similar, recently sold homes, the real estate professional can determine a fair and competitive asking price for the seller or a reasonable offer price for the buyer.

Negotiating Effectively

A well-executed CMA can also provide valuable negotiation leverage for both buyers and sellers. Sellers can use the CMA to justify their asking price, while buyers can use the analysis to support their offer price and potentially negotiate a better deal.

Identifying Market Trends and Opportunities

Comparative market analysis provides real estate professionals with a comprehensive understanding of the local market, including current trends, supply and demand, and any unique market conditions. This knowledge can help them identify market opportunities, such as undervalued properties or emerging neighborhoods with high potential for growth.

Assisting Homeowners with Home Improvement Decisions

Homeowners can also benefit from a CMA when deciding which home improvement projects to undertake. By understanding the current market value of their property and the features that are most valuable to buyers, homeowners can make informed decisions about which renovations or upgrades are likely to provide the best return on investment.

Supporting Appraisals and Financing

Lenders and appraisers often rely on comparative market analysis to determine the fair market value of a property, which is essential for securing financing and approving mortgage applications. A well-documented CMA can help ensure that the property is accurately valued and that the loan amount is appropriate for the current market conditions.

Enhancing Investor Decision-Making

For real estate investors, a comparative market analysis is a critical tool for evaluating potential investment properties and making informed decisions. By understanding the market value of a property and the potential for appreciation or rental income, investors can more accurately assess the feasibility and profitability of a real estate investment.

Key Components of a Comparative Market Analysis

A comprehensive comparative market analysis typically includes the following key components:

Property Description

The first section of a CMA should provide a detailed description of the subject property, including the address, size, number of bedrooms and bathrooms, lot size, age, and any unique features or amenities.

Comparable Property Selection

The next step is to identify and select the most relevant comparable properties. These should be similar properties that have recently sold in the same geographic area, with comparable characteristics such as size, age, and number of bedrooms and bathrooms.

Comparable Property Details

For each comparable property, the CMA should include detailed information such as the address, sale price, sale date, square footage, number of bedrooms and bathrooms, and any other relevant details that can help assess the similarities and differences between the subject property and the comps.

Adjustments and Analysis

The CMA should also include an analysis of the differences between the subject property and the comparable properties, with appropriate adjustments made to account for these differences. This may include adjustments for factors such as square footage, number of bedrooms and bathrooms, lot size, age, condition, and any unique features.

Neighborhood and Market Conditions

The CMA should also provide an overview of the local neighborhood and market conditions, including factors such as the average days on the market, current inventory levels, and any recent trends or changes in the market.

Estimated Market Value

The final component of a CMA is the estimated market value of the subject property, based on the analysis of the comparable properties and the current market conditions.

Steps to Conduct a Comparative Market Analysis

Conducting a comprehensive comparative market analysis involves several key steps. Let’s explore each step in detail:

Step 1: Gather Relevant Property Information

The first step in the CMA process is to gather detailed information about the subject property, including the address, square footage, number of bedrooms and bathrooms, lot size, age, and any unique features or amenities.

Step 2: Identify Comparable Properties

The next step is to identify comparable properties that have recently sold in the same geographic area as the subject property. These comps should have similar characteristics, such as size, age, number of bedrooms and bathrooms, and location.

Step 3: Collect Data on Comparable Properties

Once the comparable properties have been identified, the real estate professional should gather detailed information on each one, including the sale price, sale date, square footage, number of bedrooms and bathrooms, and any other relevant details.

Step 4: Analyze the Differences

The real estate professional should then analyze the differences between the subject property and the comparable properties, making adjustments as necessary to account for factors such as square footage, number of bedrooms and bathrooms, lot size, age, condition, and any unique features.

Step 5: Evaluate Market Conditions

In addition to analyzing the comparable properties, the real estate professional should also evaluate the current market conditions, including factors such as the average days on the market, current inventory levels, and any recent trends or changes in the market.

Step 6: Determine the Estimated Market Value

Based on the analysis of the comparable properties and the current market conditions, the real estate professional can then determine an estimated market value for the subject property.

Step 7: Document the Findings

Finally, the real estate professional should document the findings of the comparative market analysis, including the details of the subject property, the comparable properties, the adjustments made, and the final estimated market value.

Tools and Resources for Effective Market Analysis

Conducting a comprehensive comparative market analysis requires access to a variety of tools and resources. Let’s explore some of the most commonly used tools and resources in the real estate industry.

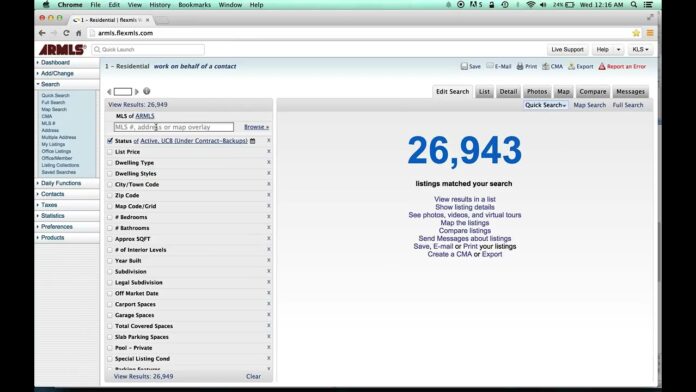

Multiple Listing Service (MLS)

The Multiple Listing Service (MLS) is a critical tool for real estate professionals, providing access to a comprehensive database of property listings and sales data. The MLS allows users to search for and analyze comparable properties, as well as track market trends and activity.

Real Estate Websites and Apps

In addition to the MLS, there are a number of real estate websites and apps that can provide valuable data and insights for comparative market analysis, such as Zillow, Redfin, and Realtor.com.

Valuation Tools and Calculators

There are a variety of online valuation tools and calculators that can help real estate professionals quickly and accurately assess the value of a property, based on factors such as recent sales, market trends, and property characteristics.

Local Market Data and Reports

Real estate professionals can also access local market data and reports from sources such as regional real estate associations, local government agencies, and private research firms. These resources can provide valuable insights into the current state of the local real estate market.

Appraisal and Mortgage Data

Lenders and appraisers often have access to a wealth of data on recent property sales and mortgage activity, which can be used to supplement the comparative market analysis process.

Demographic and Economic Data

Understanding the local demographic and economic conditions can also be crucial for effective comparative market analysis. Real estate professionals can access data on factors such as population growth, employment trends, and household income from sources like the U.S. Census Bureau and local economic development agencies.

By leveraging these tools and resources, real estate professionals can conduct comprehensive and accurate comparative market analyses, providing their clients with the information they need to make informed decisions.

Common Mistakes to Avoid in Comparative Market Analysis

While comparative market analysis is a powerful tool for real estate professionals, there are several common mistakes that can lead to inaccurate or misleading results. Here are some of the most common pitfalls to avoid:

Selecting Inappropriate Comparable Properties

One of the most critical mistakes in CMA is selecting comparable properties that are not truly representative of the subject property. This can happen when the real estate professional chooses properties that are too different in size, age, condition, or location, or that do not reflect the current market conditions.

Failing to Adjust for Differences

Even when the right comparable properties are selected, it’s important to make appropriate adjustments to account for any differences between the subject property and the comps. Failing to make these adjustments can lead to an inaccurate estimate of the property’s value.

Neglecting to Consider Market Trends and Conditions

Comparative market analysis is not just about comparing the subject property to similar recent sales; it also requires a deep understanding of the current market trends and conditions. Failing to account for factors such as inventory levels, days on the market, and buyer demand can result in an inaccurate valuation.

Relying on Outdated or Incomplete Data

Accurate and up-to-date data is essential for effective comparative market analysis. Using outdated or incomplete information, such as property sales that occurred months or years ago, can lead to inaccurate conclusions about the property’s value.

Overlooking Unique Property Features

Every property is unique, with its own set of features and characteristics that can impact its value. Failing to consider these unique features, such as the presence of a pool, a renovated kitchen, or a stunning view, can result in an undervaluation or overvaluation of the subject property.

Biased or Subjective Assessments

Real estate professionals must strive to be objective and impartial when conducting a comparative market analysis. Allowing personal biases or subjective assessments to influence the analysis can result in inaccurate valuations and poor decision-making.

Lack of Transparency and Documentation

A well-documented CMA is essential for providing transparency and supporting the real estate professional’s conclusions. Failing to clearly explain the methodology, data sources, and adjustments made can undermine the credibility of the analysis.

By being aware of these common mistakes and taking steps to avoid them, real estate professionals can ensure that their comparative market analyses are accurate, reliable, and truly valuable for their clients.

Case Studies: Successful Applications of Comparative Market Analysis

Comparative market analysis is a critical tool in the real estate industry, with numerous examples of successful applications that have helped buyers, sellers, and investors make informed decisions. Let’s explore a few case studies that illustrate the power of CMA.

Case Study 1: Pricing a Luxury Home

In this case, a real estate agent was tasked with pricing a high-end luxury home in a desirable neighborhood. By conducting a thorough comparative market analysis, the agent was able to identify several recently sold properties with similar characteristics, such as square footage, number of bedrooms and bathrooms, and amenities. After making appropriate adjustments to account for differences, the agent was able to price the home competitively, leading to a quick sale at a price that was within the seller’s desired range.

Case Study 2: Negotiating a Fair Offer for a Buyer

A first-time homebuyer had found a property that they were interested in, but they were unsure of the appropriate offer price. The real estate agent conducted a comprehensive CMA, analyzing the recently sold comparable properties and taking into account factors such as market conditions and the property’s unique features. Armed with this data, the buyer was able to negotiate a fair offer price that was supported by the CMA, ultimately securing the property at a price they were comfortable with.

Case Study 3: Evaluating a Potential Investment Property

An experienced real estate investor was considering the purchase of a multi-family property as a rental investment. The investor’s agent conducted a thorough CMA, analyzing the rents and occupancy rates of similar properties in the area, as well as the overall market trends and demand for rental units. The CMA allowed the investor to accurately assess the potential return on investment and make an informed decision to proceed with the purchase, ultimately leading to a successful and profitable investment.

Case Study 4: Supporting a Property Appraisal

In this case, a homeowner was seeking to refinance their property, but the lender required a professional appraisal to determine the home’s fair market value. The real estate agent provided the appraiser with a comprehensive CMA, including details on comparable sales, market conditions, and any adjustments made to account for differences. The well-documented CMA helped the appraiser accurately assess the property’s value, allowing the homeowner to secure the refinancing they needed.

These case studies demonstrate the versatility and importance of comparative market analysis in the real estate industry. By leveraging this powerful tool, real estate professionals can help buyers, sellers, and investors make informed decisions, negotiate effectively, and ultimately achieve their goals.

Future Trends in Comparative Market Analysis

As the real estate industry continues to evolve, the practice of comparative market analysis is also likely to undergo significant changes and advancements. Here are some of the key trends and developments that are expected to shape the future of CMA:

Increased Automation and Digitalization

The real estate industry is already seeing a growing trend towards automation and digitalization, with the development of advanced software and online tools that can streamline the CMA process. This includes the use of artificial intelligence and machine learning algorithms to analyze large datasets and identify the most relevant comparable properties.

Incorporation of Big Data and Analytics

In addition to automation, the future of CMA is also likely to involve the increased use of big data and advanced analytics. By tapping into a wider range of data sources, such as social media, satellite imagery, and demographic information, real estate professionals can gain a more comprehensive understanding of the local market and make more informed decisions.

Predictive Modeling and Forecasting

As the volume and complexity of data continue to grow, real estate professionals will increasingly rely on predictive modeling and forecasting techniques to anticipate future market trends and conditions. This can help them make more accurate valuations and better-informed decisions about buying, selling, or investing in properties.

Personalized and Customized Analyses

With the rise of advanced technologies and data-driven decision-making, CMA is also likely to become more personalized and customized to the needs of individual clients. Real estate professionals may use a combination of automated tools and human expertise to create tailored analyses that take into account the unique circumstances and preferences of their clients.

Increased Integration with Other Real Estate Technologies

As the real estate industry continues to embrace technological advancements, comparative market analysis is likely to become more closely integrated with other real estate technologies, such as property management software, customer relationship management (CRM) systems, and virtual tour platforms. This integration can help streamline the CMA process and provide a more holistic view of the real estate market.

Greater Transparency and Accessibility

Finally, the future of CMA may also involve greater transparency and accessibility for both real estate professionals and their clients. As the industry becomes more data-driven, there may be increased pressure for real estate companies to provide more detailed and accessible information about their CMA methodologies and findings, helping to build trust and confidence in the real estate process.

Overall, the future of comparative market analysis in real estate is likely to be characterized by increased automation, the incorporation of big data and advanced analytics, and a greater emphasis on personalization and integration with other real estate technologies. By staying ahead of these trends, real estate professionals can ensure that they continue to provide their clients with accurate, reliable, and valuable insights into the real estate market.

Conclusion

Comparative market analysis is a crucial tool in the real estate industry, providing essential insights that help buyers, sellers, and investors make informed decisions. By understanding the key components of a CMA, the steps involved in conducting an effective analysis, and the various tools and resources available, real estate professionals can leverage this powerful tool to achieve their clients’ goals.

However, it’s essential to be aware of the common mistakes that can undermine the accuracy and reliability of a CMA, and to take steps to avoid them. By staying vigilant and continuously