When it comes to protecting your most valuable assets—your home and vehicle—finding the right insurance coverage at the best price is crucial. In this guide, we’ll help you navigate the process of obtaining home and auto insurance quotes, ensuring you understand the basics and how to maximize your savings. From the benefits of bundling policies to factors influencing insurance rates, we’ll break down essential tips for comparing quotes, finding discounts, and avoiding common mistakes. By the end, you’ll be better equipped to secure comprehensive coverage while staying within your budget, making informed decisions that offer peace of mind.

creditpert.com invites you to explore this topic thoroughly.

1. Understanding the Basics of Home and Auto Insurance

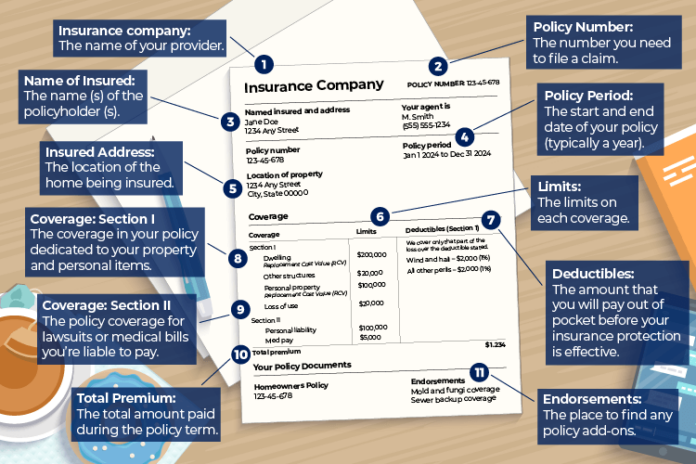

Home and auto insurance are crucial for protecting your valuable assets from unforeseen events like accidents, theft, or natural disasters. Home insurance safeguards your dwelling, personal belongings, and provides liability coverage if someone sustains injuries on your property. It can also cover additional living expenses should your home become uninhabitable due to a covered event.

Auto insurance, on the other hand, encompasses liability coverage for bodily injury and property damage. It also offers optional coverages such as collision, comprehensive, and uninsured motorist protection. While every state mandates minimum auto insurance requirements, exceeding these limits is often advisable for comprehensive protection.

To effectively evaluate insurance quotes, understanding the key components of both home and auto insurance is essential. This includes factors like deductibles, coverage limits, and exclusions. The goal is to find policies that offer sufficient protection without overspending, ensuring a balance between coverage and affordability. By familiarizing yourself with these basics, you’ll be better equipped to compare quotes and choose policies tailored to your individual needs.

2. Benefits of Bundling Home and Auto Insurance

Bundling your home and auto insurance, or purchasing both policies from the same provider, provides multiple benefits that can save you money and simplify your coverage. A key advantage is the opportunity for discounts. Many insurers offer multi-policy discounts, which can significantly reduce your premiums when you bundle. This strategy effectively lowers your total insurance costs while ensuring comprehensive protection for both your home and vehicle.

Bundling your home and auto insurance offers more than just savings; it streamlines policy management. With a single insurer for both, you’ll enjoy a simplified experience. Instead of juggling multiple companies, you’ll have one point of contact for all your needs, including tracking payments, renewals, and claims. Additionally, some insurers provide combined deductibles for bundled policies. This means you might only have to meet one deductible if both your home and car are damaged in the same event, such as a storm or fire.

Moreover, bundling your insurance policies can foster customer loyalty, resulting in enhanced service and tailored coverage choices over time. Combining your home and auto insurance not only provides financial benefits but also streamlines your insurance experience, offering greater ease and convenience.

3. Factors Influencing Home and Auto Insurance Quotes

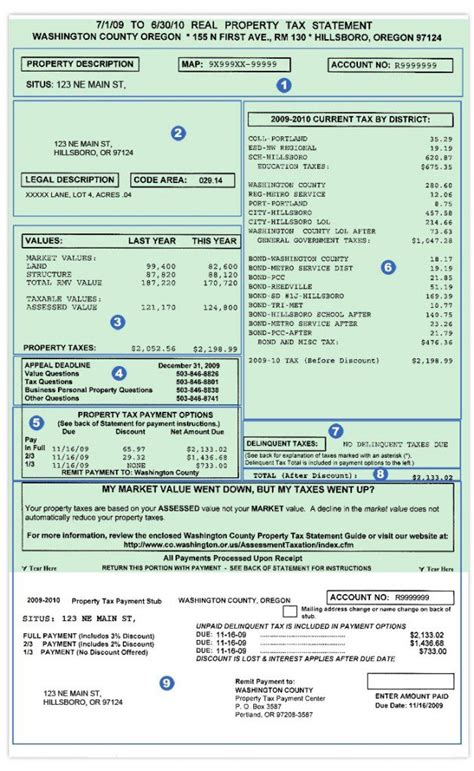

Several key factors influence the quotes you receive for home and auto insurance, and understanding these can help you get the best rates. For home insurance, factors like the age, location, and construction materials of your home play a significant role. Homes located in areas prone to natural disasters or crime typically have higher premiums. The size of your home, its replacement cost, and your personal claims history also influence the quote.

Your auto insurance quote is determined by a variety of factors, including your driving history, the type of vehicle you own, and your location. Drivers with a clean record and safe driving habits typically receive lower premiums. On the other hand, owning a high-performance or expensive vehicle can lead to higher rates. Furthermore, your age, credit score, and how often you use your vehicle are also considered when calculating your premium.

By understanding these factors, you can compare insurance quotes more effectively and take steps to reduce your premiums. These steps could include improving your credit score or installing safety features in your home or vehicle.

4. Tips for Comparing Insurance Quotes Effectively

When comparing home and auto insurance quotes, price alone shouldn’t be your only consideration. It’s crucial to ensure you have adequate coverage. Start by examining the coverage limits for both your home and vehicle, making sure they are sufficient to protect your valuable assets. Additionally, scrutinize the deductibles, as they can significantly impact your premiums. Remember that a higher deductible typically translates to lower premiums, but it also means you’ll be responsible for a larger out-of-pocket payment if you need to file a claim.

When comparing insurance providers, it’s crucial to ensure you’re comparing apples to apples. This means comparing policies with equivalent coverage levels, such as similar liability limits, comprehensive coverage, and optional features like roadside assistance or personal property replacement.

Don’t forget to ask about potential discounts that might not be automatically applied, such as multi-policy, safe driver, or home security system discounts. It’s also important to consider the insurer’s reputation and customer service reviews, as a company with poor service might not be worth the savings. By carefully comparing all these factors, you can find the most cost-effective insurance without sacrificing coverage.

5. How to Find Discounts on Home and Auto Insurance

Lowering your home and auto insurance premiums without compromising coverage is achievable. One simple way to save is by bundling your policies with the same insurer, often earning you a multi-policy discount. Moreover, many insurers offer discounts for incorporating safety and security features in your home, like smoke detectors, burglar alarms, and deadbolt locks.

You can potentially lower your auto insurance premiums by:

* Maintaining a clean driving record.

* Completing a defensive driving course.

* Driving fewer miles annually.

Additionally, some insurance companies offer discounts for vehicles equipped with anti-theft devices or advanced safety features such as airbags and anti-lock brakes.

Membership in specific professional organizations or alumni associations could qualify you for group discounts. Additionally, inquire with your insurer about loyalty discounts for long-term policyholders or incentives for choosing paperless communication. Utilizing these discounts can significantly reduce your insurance costs while ensuring sufficient coverage.

6. Common Mistakes to Avoid When Getting Insurance Quotes

When seeking quotes for home and auto insurance, several common mistakes can result in higher premiums or insufficient coverage. A significant error is neglecting to compare enough quotes. Shopping around is crucial as prices and coverage options can differ greatly between insurers. Omitting to compare at least three quotes could mean missing out on better rates or more comprehensive coverage.

Don’t be fooled by the lowest price alone. While a cheaper insurance policy might seem appealing, it could mean insufficient coverage in the event of an accident or property damage. To make an informed decision, carefully compare the specific details of each policy, including the types of coverage, limits, and deductibles, before choosing the best fit for your needs.

It’s easy to overlook available discounts when purchasing insurance. Failing to inquire about multi-policy discounts, safe driver rewards, or home safety incentives can mean missing out on significant savings.

Finally, neglecting to update your information, including changes to your credit score, home improvements, or vehicle safety features, can lead to inaccurate insurance quotes. Maintaining updated personal information ensures your policy accurately reflects your current situation, resulting in the most accurate and cost-effective quote. By avoiding these oversights, you can secure better insurance coverage at a more competitive price.

7. The Impact of Your Credit Score on Insurance Quotes

Your credit score significantly influences the quotes you receive for home and auto insurance, ultimately impacting the premiums you pay. Insurers use credit scores to assess risk, viewing individuals with higher scores as more responsible and less prone to filing claims. Consequently, those with good credit often benefit from lower premiums compared to those with poor credit.

Insurance companies carefully examine your credit history, taking into account your payment patterns, outstanding debts, how much credit you’re using, and the length of your credit history. Having a strong credit profile can significantly lower your insurance costs. Conversely, a poor credit score may lead to higher premiums or even make it challenging to secure insurance coverage.

A proactive approach to lowering your insurance rates is improving your credit score. This can be achieved by prioritizing timely bill payments, reducing outstanding debt, and maintaining a balanced portfolio of credit types. Additionally, regularly reviewing your credit report for errors and disputing any inaccuracies can significantly benefit your score. By recognizing the correlation between credit score and insurance quotes, you can take steps to enhance your financial well-being, potentially leading to savings on your insurance premiums.

8. Steps to Take After Receiving Insurance Quotes

When you receive home and auto insurance quotes, it’s crucial to take a methodical approach to selecting the best policy for your needs. Begin by carefully reviewing each quote, comparing coverage limits, deductibles, and any included features or riders. Ensure that all quotes are based on similar coverage options to guarantee a fair and accurate comparison.

Next, thoroughly assess the insurer’s reputation. This involves examining customer reviews and ratings, as well as researching their claims process and customer service track record. This step ensures you select an insurer known for providing reliable support when needed.

If you have any questions about the terms or conditions of your insurance policy, don’t hesitate to contact your insurance agent for clarification. Asking questions can also help you gauge the insurer’s responsiveness and assess their overall customer service quality.

If you find a quote that suits your needs, don’t be afraid to negotiate with the insurer. Many companies are willing to adjust premiums or provide additional discounts to win your business.

Before signing any policy documents, it is essential to carefully review them. Verify that all details are accurate and consistent with the discussions you had with your agent. This thorough review will safeguard your interests and guarantee that your insurance coverage meets your specific needs.

Navigating home and auto insurance can be complex, but understanding key aspects—from quotes to discounts—empowers you to make informed decisions. By comparing policies, avoiding common pitfalls, and leveraging your credit score, you can secure the best coverage at the most competitive rates. Ultimately, taking the time to explore your options will ensure peace of mind and financial protection for your assets.

creditpert.com